The Cliff Notes version of how Donald Trump got elected for a second time rests on two pillars, the culture and the economy. Turns out that people don’t like inflation, don’t like DEI, and don’t like the feeling they’ve been left behind in the employment sweepstakes. One of the 2024 election mandates was fixing those problems, and Donald Trump got the memo.

But… When we named our podcast and substack “What the Hell is Going On?” we didn’t realize quite how apt the question would be every single week. This week, What the Hell focuses on the economy with AEI’s Director of Economic Studies Michael Strain. Because, if the memo said “fix” the economy, that’s not what Donald Trump seems to be doing.

Let’s start with the good news: The economy has thus far been in great shape in the Trump term. Inflation is down, unemployment is steady and declining, wage growth is solid, and many early polls suggested that the American people were very optimistic about DJT, season 2. The stock market agreed, and if there was a bubble that Wall Street droobs worried was going to burst, investors disagreed. But that was yesterday’s news. Today’s is less rosy.

Consumer confidence has plummeted to levels not seen since the Biden presidency… Per the NYT:

A new survey released on Friday showed consumer sentiment plummeting 11 percent in March as Americans of all ages, income groups and political affiliations turned even more downbeat about the trajectory for the economy. Consumer confidence has fallen for the third consecutive month, not only about personal finances, but also the job market and stock markets. Since December, sentiment has tumbled 22 percent.

Youch.

What’s the word that surfaces most frequently when consumers cite concerns about the trajectory of the economy? “Uncertainty.” Donald Trump “loves” tariffs, and his on-again-off-again threats to impose massive tariffs on America’s main trading partners are at the heart of much of this uncertainty. Check out the Tax Foundation’s tariff tracker:

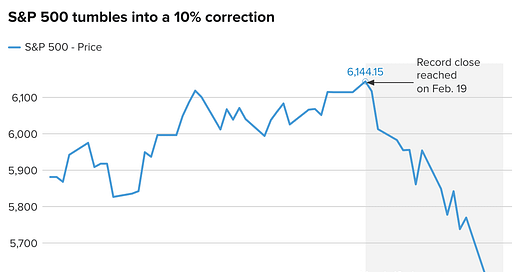

Yeah, it’s a long list. Here are some other pictures that give heartburn to workers and people with 401ks:

To put it simply, Donald Trump likes to think of himself as a problem solver, a man who uses the leverage the office affords him to fix what he sees as the predations of foreigners on the American people. Unfortunately, every problem he identifies is a nail, and his only hammer appears to be tariffs.

The average Joe doesn’t think much about tariffs, or whether a Value Added Tax is a foreign tariff (it isn’t). The average Joe looks at the security of his job, and maybe the value of his investments, and hopes that things will be better tomorrow. And the average American’s once-high confidence in Donald Trump delivering those things has plummeted. (It doesn’t help that Trump has refused to rule out a recession.)

Last week's Quinnipiac poll delivered the bad news: Less than two months in, 53 percent of Americans disapprove of Donald Trump’s performance, a drop of 11 points since January 29. Similarly, 58 percent disapprove of Trump’s handling of Canada, and 56 percent disapproved of his efforts on Mexico. And a CNN poll delivered a dismal 56 percent disapproval rating for Donald Trump’s economic policies (his worst rating in this particular poll, including during his first term).

Donald Trump argues that he is rebuilding the economy, reshaping it, and reducing government spending and that that’s going to cause pain. The problem, retorts Strain, is that he’s not doing that. In the first instance, all of the changes being instituted by the White House, like them or not, are being made through Executive Orders, not by law. And thus, as Trump ripped up Biden’s EOs, his successor will be able to rip up his.

Then there’s DOGE. While the legacy media is obsessed with the plaints of AID employees and other entitled DC denizens with federal sinecures, the real challenge for Elon Musk is that the bulk of federal spending is in entitlements. And Trump has deemed those untouchable. Absent a willingness to address Social Security’s impending bankruptcy, as well as exploding Medicare and Medicaid costs, cutting development spending and recouping overhead from medical centers isn’t going to make a dent in federal spending. Especially when the President wants to end taxes on social security, tips, and much else.

Is Donald Trump kicking butt on immigration? Yep. Is he keeping promises on DEI? He sure is. Is he shepherding the economy towards full employment and growth? Not by my math. And the uncertainty and capriciousness are a killer. The good news for DJT is that it will not be difficult to right the ship… as long as the president recognizes there are icebergs ahead.

HIGHLIGHTS

What is the state of the economy right now?

MS: The economy is in very good shape. The fundamentals of the economy are very strong. We have a very healthy tight labor market. We have households that are earning lots of income, households that are spending that income, the data that have come in, the hard data on actual economic activity show that things are looking really good.

Why do you think the economy’s in good shape?

MS: We get data on people filing for unemployment insurance benefits every week, and those data don't show any real uptick in unemployment insurance benefit claims. The last round of labor market data on employment and unemployment showed that the labor market remains strong, wage growth remains strong. So all the kind of hard indicators of how the economy is doing in the first quarter with a few exceptions, but in my judgment, the balance of the data for the first quarter of 2025 shows an economy in really, really good shape.

If the economy is so good, why are there fears of a recession?

MS: When you don't look at hard data and when you look instead at how households and businesses are feeling about the economy and how they're feeling about the coming months. They're pretty gloomy. Households are pretty gloomy about the economic outlook. Businesses are almost surely really pulling back on investment spending and pulling back on expansion plans. Quite likely they're going to pull back on hiring plans. You're starting to see more and more anecdotes. The airlines came out today and said that business travel, reservations for future business travel are way down. And so I think Marc's joke really captures the situation. You've got this really terrific economy and an economy where the outlook was strong when President Trump took office as investors and businesses tried to forecast what he was going to do with economic policy, people were feeling really good.

So in an economy that is in great shape, an economy that people are feeling really good about, then throw a trade war into that. Throw the kind of haphazard chaotic nature of some of the DOGE cuts, some of the DOGE activities, the Elon Musk stuff into that and people are feeling bad. We don't have any direct evidence yet that the bad feeling is translating into people cutting back on spending, but that's surely going to happen. And so the question now is just how much weakness is the economy going to suffer from and how long do we live in a world with where President Trump is engaging at this level of erraticness with policy?

How well is the White House managing the economy?

MS: I think what we're seeing is a mix of crazy and poor execution. And so take the DOGE stuff, it is laudable, admirable to attempt to reduce the scope of government activity. It is obviously laudable and admirable to try and reduce government spending, waste, fraud, abuse, to try to increase the efficiency of government programs. These are goals that I share and that I know the three of us have held for a very long time. I think the execution leaves a lot to be desired. I don't think the activities of Mr. Musk and his colleagues are going to actually work. I mean we're not going to see big reductions in the size and scope of the government as a consequence of what they're doing. And in the meantime, I think they're spooking enough people that we really could see an impact from DOGE on consumer spending and that it will slow consumer spending. We could see that weaken the overall outlook for the economy.

On the trade issue, it is just so hard to assess because it is completely unclear what the goals are and you hear different things from different members of the administration. You hear different things from the same folks over time that are just incoherent. And so one purported goal is to increase government revenue from tariffs. So you bring in a bunch of money by increasing tariff rates and that can finance additional income tax cuts. Another rationale is to stop the supposed inflow of fentanyl from Canada. Another rationale is to stop inflows of illegal immigration. Another rationale is to revive domestic manufacturing. Another rationale is to get better deals from other countries in terms of actual actual trade agreements. Another rationale is to reduce the trade deficit to start having balanced trade bilaterally or even trade surpluses.

And so how do you know if this is working or not? Many of these goals are at cross purposes and so if the goal is to generate all this revenue and kind of bring back a President McKinley era economy, that goal is inconsistent with the goal of stopping fentanyl because presumably you put the tariffs on, the tariffs are going to be effective, the fentanyl stops, and then the tariffs go away. And this is not a permanent source of revenue. If the goal, you hear a lot about reciprocal trade. And so if the goal is to really jack up tariff rates in an effort to get other countries to reduce their tariff rates, and if we're going to follow a reciprocal policy where therefore we reduce our rates, what other countries reduce theirs, that goal is inconsistent with the goal of moving a whole bunch of economic activity back to the United States.

And so it's very hard to know what the actual rationale is, but I think we can say with a very high degree of confidence that there is no reasonable justification for what President Trump is doing with Canada. There's no real reasonable justification for high across-the-board tariffs on imports from Europe. I think we should continue to put China in a separate category. I don't support the administration's approach to tariffs on Chinese imports. I would go so far as to say that a lot of what the administration is doing is unreasonable. But I mean I think China is a nation-

Reasonable people can disagree.

MS: Yeah, I think there's a reasonable people can disagree element to what's happening with China, but Canada, Europe, Mexico, it's just much harder to justify that based on any of the many rationales that you see advanced by the President and others in the administration.

What causes you to conclude that the tariffs are being applied so unreasonably?

MS: Think about these auto tariffs for example. A car that is built in North America will cross the Mexican or Canadian border a half-dozen times, a dozen times in and out of the United States. The way the President's executive order was written, my understanding is that the tariff would hit the car every time it crossed the border. This is why the auto companies were so upset about this. And so you're going to take a car and you're going to add $10,000 to the price of that car and it's going to be an American that pays for most of that.

Now that we're talking about a 50% tariff, again, this is the afternoon of March 11th and President Trump has floated taking the 25% tariff on Canada to 50%. That's even more money out of the pocket of Americans. We don't have to have the conversation in the abstract. We can look at what happened in 2018 and 2019 the last time we went through something like this. And what happened? Well, consumer prices increased, so American consumers bore the cost of much of the tariff increases that the Trump administration put in place. Domestic manufacturing firms became less competitive because if you want to manufacture products in the United States, turns out that a lot of what you need to do that you have to import from other nations.

And so when President Trump increased tariff rates, he was increasing the costs of production for US manufacturing companies. Manufacturing employment went down because American manufacturing companies were less competitive. They hired less and manufacturing employment actually went down. The US trade deficit was completely unaffected by the President's tariff increases because turns out that's not the driver of the trade deficit and other nations retaliated against the United States, which is happening this time around or going to happen this time around. And the retaliation got so bad that President Trump had to bail out the agriculture sector because other nations targeted US agricultural exports for retaliation.

And so this doesn't do anything. I mean nothing is being achieved. US manufacturing is worse off. American workers are worse off, American consumers are worse off, the trade deficit is unaffected. American exporters are worse off. This is a lose, lose, lose, lose, lose, lose proposition. And the reason for that is because the world just doesn't work the way that the White House thinks it does, and these policies just aren't going to have the effects that the White House seems to think they're going to have. And that's I think not going to change.

Now, if the goal is not economic, right, so if the goal is to put high tariffs on Mexican imports to try and encourage the Mexican government to correct out on illegal immigration. That could work. I don't quite know how you would try to forecast the likelihood of success there, but that's not crazy by any means. But the right way to think about this then is that the American people are going to bear an economic cost in order to achieve the goal of reductions in illegal immigrants from Mexico. It's not the case that the American people get all these great benefits from a trade war and in addition we get fewer illegal immigrants.

The White House claims that the U.S. is paying $370 billion in tariffs to other countries and only taking in $50 billion. How would you fix that if not through reciprocal tariffs?

MS: I would like to see freer trade across the board. I think that conversation deserves some nuance. There are national security issues obviously with trading with China and trading with some other nations for certain products and certain services. And so I don't think you want to have a world where there are literally no trade barriers. I think you do want to have some, but kind of apart from special circumstances like that, I would like to see the US reduce its trade barriers. I would like to see other nations reduce their trade barriers and that was the direction of travel in the United States and around the world for decades. I'm not totally sure of the numbers Marc that you're citing. I think some members of the administration have been including European sales taxes and calling that a trade barrier.

Is a value added tax (VAT) a backdoor tariff?

MS: No, it's not. But this is an argument that you're hearing from senior members of the administration and it's just economic nonsense. The VAT applies to goods that are produced and sold in those European countries. It applies to goods are that sold in those countries that are produced in the United States and it's applied evenly. And so it's the same rate. And so international law does not recognize that as a trade barrier. And in fact, international law explicitly recognizes it as not a trade barrier. The World Trade Organization does not consider those trade barriers. It's a sales tax.

The White House is claiming that they are systematically changing an American economy that is reliant on government spending, and that is why markets are down. Is that a coherent argument and is it true?

MS: Yeah, so I agree with you that it's kind of incoherent and the Treasury secretary argued that I think he was arguing that financial markets were reacting to a detox was the word he used. Detox because we had gotten so hooked on government spending that we were kind of detoxing, getting rid of our addiction to government spending and we were going to come out the other side better off and obviously less addicted.

What is the problem with that argument?

MS: The problem with that argument of course is that there has not been a reduction in government spending, and so the entire metaphor just completely falls apart. It's like if you were addicted to heroin, you were convulsing on the floor, but you had kept taking heroin and saying that you were detoxing. Obviously you're not because you're still using heroin that you're reacting to something else. And so that was just a very strange thing to say. I mean, if the government had slashed spending in the month of February or was slashing spending in the month of March, then maybe that would make sense, but nothing like that at all is happening, either in terms of the amount of money that goes out the door from the federal government or in terms of the number of people who work for the federal government. It's just not a lot of cutting has happened.

President Trump surprised me frankly on Sunday in the other comments that you're referring to. He was asked about financial markets. He was asked about the outlook for a recession and he said that his job was to create a strong nation and that you can't really judge that on a quarter-to-quarter basis and that China has a hundred-year time horizon and that the globalist corporations have been destroying America and he's trying to stop that and build something better.

That is not the way that I remember President Trump ever talking and it spooked me on Sunday, and I think it spooked markets yesterday on Monday as well. President Trump has always talked about his policies as strengthening the country. We're going to do these things because they're going to make American's incomes go up. They're going to make America a richer, more prosperous nation and that that's going to happen in a normal time horizon. America's going to become a more prosperous nation this year, not 50 years from now or 80 years from now or something like that.

The White House is only at the beginning of the process of slashing government spending, though, right?

MS: I interpreted Secretary Bessent as saying that the market was reacting to spending cuts that had already happened. And so I interpreted him as being guilty of severely exaggerating what DOGE has done. I did not interpret him as indicating that markets were tanking because they were expecting cuts to come in the future, even if that is what he meant. The huge, huge flaw in President Trump's plans for reducing the size of government is that he is adamant about not reducing future spending on Medicare and Social Security. And so if you look at everything the government spends money on, there are exactly three categories of spending that are projected to grow over the next 10 years. Social Security, Medicare, and interest payments on the debt. President Trump has said, "We're not going to cut Social Security, we're not going to cut Medicare."

And so that really leaves hollow his goal of reducing the size of government, reducing government spending, addressing the nation's fiscal imbalance. Now there's the size of government and then there's the scope of government and he might make some progress on the scope of government. Conservatives have long wanted, for example, to abolish the Department of Education. Hadn't really taken a good swing at that really since President Reagan. And so maybe there will be at the end of President Trump's term, we'll be able to look back and say the scope of government was decreased, which I think would be great, but President Trump is really tying not just one hand behind his back. He's tying both hands behind his back in terms of reducing government spending by taking off the table the two programs that are driving the nation's fiscal imbalance.

How will these tariffs and this shaky economy affect Trump politically in the long run?

MS: I think the laws of political gravity still hold, and I think the President thinks that these tariffs are going to create good outcomes, and I just don't think that's the case. As the bad outcomes pile up and as the severity of badness increases, the President's approval rating is going to go down. As his approval rating goes down, Republicans in the Senate and the House, Republican governors and business leaders are going to feel more and more comfortable publicly criticizing him. And provided that he cares about winning the midterm elections, he's going to have to cool it with some of this damaging stuff.

Read the full transcript here.

SHOWNOTES

Trump says he's doubling tariffs on Canadian steel and aluminum to 50% (CBS News, March 11, 2025)

Tariff delays: Uncovering the most impacted sectors (J.P. Morgan, March 10, 2025)

Trump says he paused some tariffs to ‘help’ Mexico and Canada to a ‘certain extent’ (Fox Business Sunday Morning Futures, Transcript via Roll Call, March 10, 2025)

Commerce Secretary Lutnick emphatically shoots down recession concerns – and reveals how Canada, Mexico can get tariffs lifted (New York Post, March 9, 2025)

Trump changes course and delays some tariffs on Mexico and Canada (AP News, March 6, 2025)

Stock Market Today: Trade Threats Send Dow Down 400 Points (WSJ, March 11, 2025)

Dow plunges more than 1,000 points, Nasdaq craters as recession fears batter stocks (CBS News, March 11, 2025)

Treasury Secretary Bessent says economy could be ‘starting to roll a little bit’ (CNBC, March 7, 2025)

GDPNow (Federal Reserve Bank of Atlanta, Latest estimate March 6, 2025)

How Trump Can Achieve Sustained Growth (Project Syndicate, February 20, 2025)

Trump has made a good start (Financial Times, January 31, 2025)

US Tariffs Will Not Bring Back Jobs from China (Project Syndicate, October 21, 2024)

Trump’s Tariffs Are No ‘Emergency’ (Editorial Board, WSJ, March 6, 2025)

The Trump Tariff Roller Coaster (Editorial Board, WSJ, March 5, 2025)

Congress Can Stop This Tariff Madness Right Now (Charles C. W. Cooke, National Review, March 4, 2025)

Trump Takes the Dumbest Tariff Plunge (Editorial Board, WSJ, March 3, 2025)

Sunday morning with #WTH. Almost like the old days with the Sunday Newspapers.

Economic tariffs will certainly make us poorer. Limited security tariffs will make us stronger. Does anyone in politics have the wisdom to distinguish the two?

Our ability to plan for the future contributes to the well being of the economy, along with freedom to choose. Let's get on with what Reagan wanted-- a free and independent populace free from government intervention. I think that is the message Mike was saying. Thanks and take care.

Amen